Roth ira growth calculator

Traditional or Rollover Your 401k Today. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

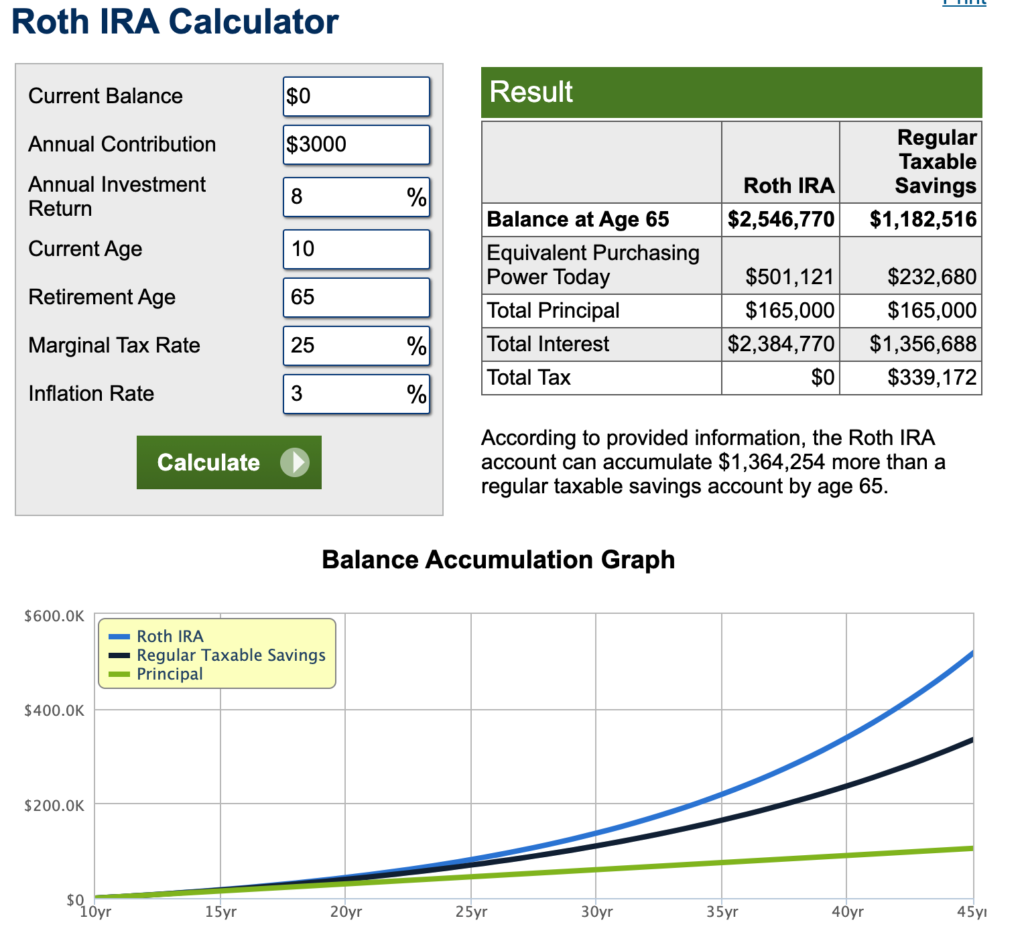

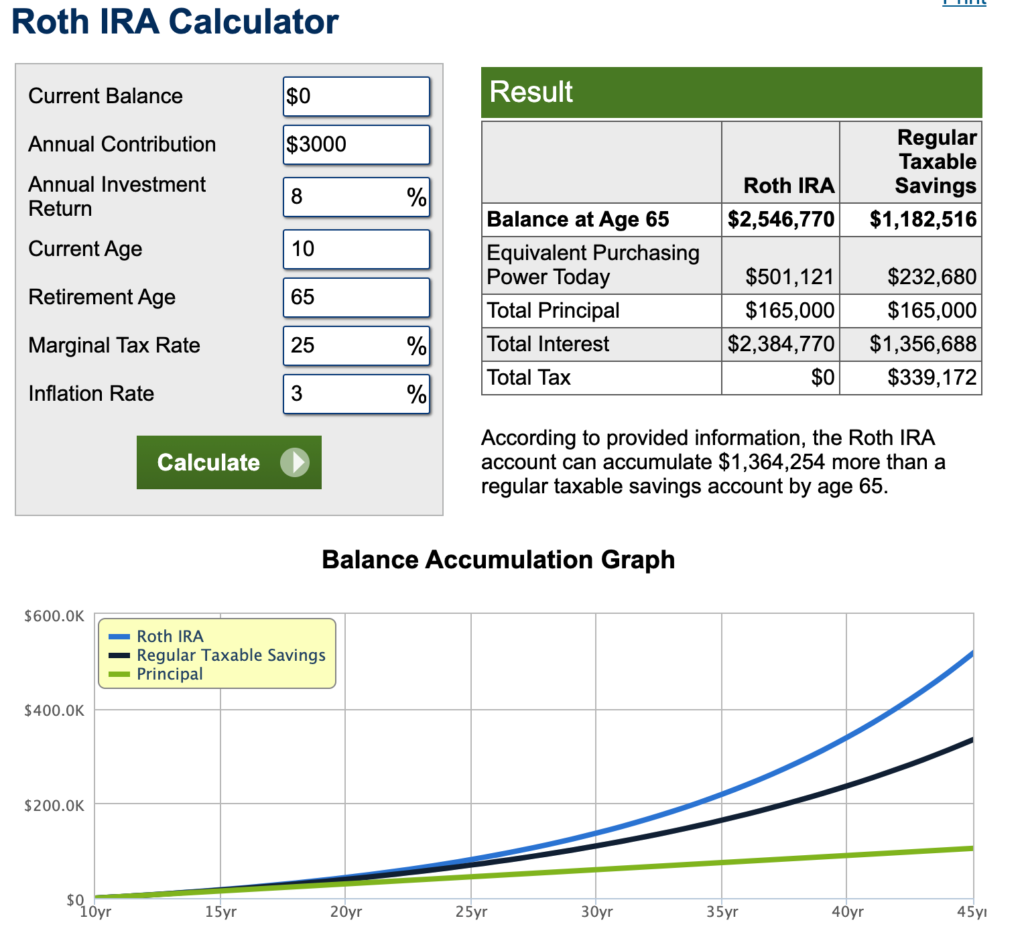

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

. The Roth 401 k allows contributions to. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Open an IRA Explore Roth vs.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. Find Out Which IRA Plan Works Best for You. For the purposes of this calculator we assume that.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

Ad Its a rough ride for many investors but theres plenty to like about these 5 stocks. The amount you will contribute to your Roth IRA each year. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Get Up To 600 When Funding A New IRA. This calculator assumes that you make your contribution at the beginning of each year. Discover Bank Member FDIC.

The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each year. Married filing jointly or head of household.

Creating a Roth IRA can make a big difference in your retirement savings. Find a Dedicated Financial Advisor Now. For 2022 the maximum annual IRA.

Its Never Too Early to Invest in Your Future. Do Your Investments Align with Your Goals. Community and investing resources are waiting for you here.

For 2022 the maximum annual IRA. Get Up To 600 When Funding A New IRA. Explore Choices For Your IRA Now.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. A 401 k can be an effective retirement tool.

Use this Roth IRA calculator to find out if this is the right investment option for you. Do Your Investments Align with Your Goals. This calculator assumes that you make your contribution at the beginning of each year.

The Roth IRA can provide truly tax-free growth. For the purposes of this. The amount you will contribute to your Roth IRA each year.

If youre ready to maximize your retirement savings with the tax-free growth that a Roth IRA can. Ad Open a Roth or Traditional IRA CD Today. Ad What Are Your Priorities.

The amount you will contribute to your Roth IRA each year. While long-term savings in a Roth IRA may. Find a Dedicated Financial Advisor Now.

This calculator assumes that you make your contribution at the beginning of each year. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

1001 Liberty Ave Pittsburgh PA 15222-3779. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings.

Married filing jointly or head of household. Ad Explore Your Choices For Your IRA. With Merrill Explore 7 Priorities That May Matter Most To You.

For 2022 the maximum annual IRA. Creating a Roth IRA can make a big difference in your retirement savings. Creating a Roth IRA can make a big difference in your retirement savings.

Not sure how to get started. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Calculate your earnings and more.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Build Your Future With a Firm that has 85 Years of Retirement Experience. Calculate your earnings and more.

Not everyone is eligible to contribute this. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Roth Ira Calculators

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Best Roth Ira Calculators

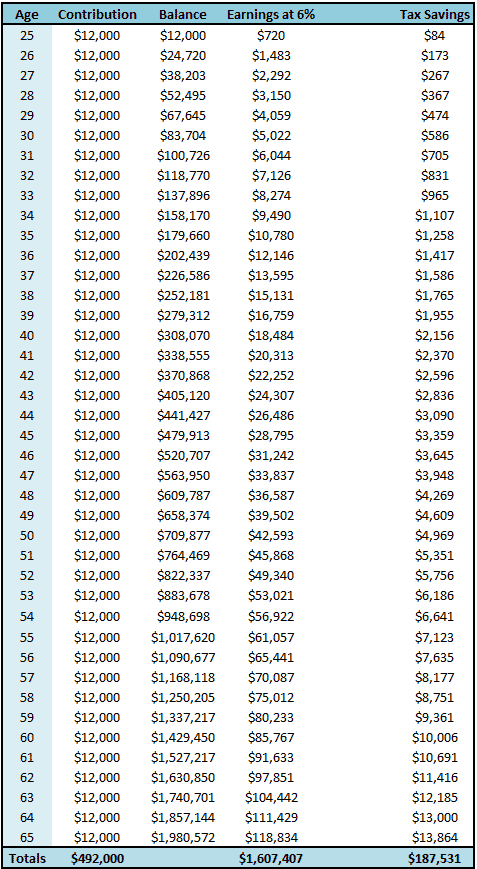

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Systematic Partial Roth Conversions Recharacterizations

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Traditional Vs Roth Ira Calculator

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Historical Roth Ira Contribution Limits Since The Beginning

Roth Ira For Kids A Truly Life Changing Strategy See The Forest Through The Trees